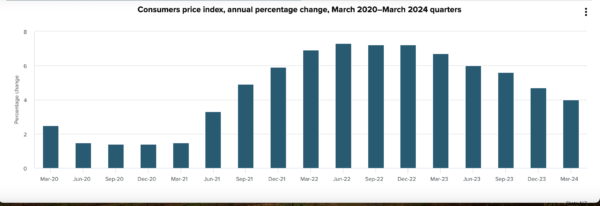

New Zealand’s consumers price index increased 4 per cent in the 12 months to the March 2024 quarter, according to figures released by Stats NZ April 17. This was higher than the Reserve Bank prediction of 3.8%.

The 4 per cent increase follows a 4.7 per cent increase in the 12 months to the December 2023 quarter. ”Price increases this quarter are the smallest since June 2021. However, they remain above the Reserve Bank of New Zealand’s target range of 1 to 3 per cent,” Consumer Prices senior manager Nicola Growden said.

Non-tradeable inflation, that is the price rises of goods and services produced domestically, was 5.8 per cent in the 12 months to the March 2024 quarter (compared with 5.9 per cent in the 12 months to the December 2023 quarter), driven by rent, construction of new houses, and cigarettes and tobacco.

Statistics NZ NZ also reports that the cost of living for the average New Zealand household increased 7.0 percent in the 12 months to the December 2023 quarter.

“The 7.0 percent increase, measured by the household living-cost price indexes, follows a 7.4 percent increase in the 12 months to the September 2023 quarter.

“Inflation, as measured by the consumers price index, eased more than the cost-of-living over 2023. This is because our cost-of-living measure includes different ongoing costs that aren’t included in the CPI, such as interest payments, which have increased by 31 percent for the average household over the past 12 months,” consumer prices manager James Mitchell said.

There are two prominent arguments usually given by bourgeois economists for the cause of inflation. One argument is that inflation is caused by wage increases coupled with supply and demand problems. This view is associated with those of the great British economist John Maymard Keynes. The other argument is that inflation is seen merely as a monetary phenomenon linked to the amount of money in circulation. This view was associated with that of the US economist Milton Friedman.

In New Zealand the economic debate is essentially between these schools of thought.

Progressive economist Susan St John seems pretty clearly in the school of Keynes when she writes:

“The old ‘money chasing too few goods’ explanation of inflation is far from satisfactory and leads to punitive recessionary policies and tight monetary policy. It is better to think of inflation in terms of demand and supply in the context of the state of the economy.

“But the figures show we are already in a recession and its effects are evidenced daily by welfare agencies dealing with increasingly high needs. This means there is slack in the economy and suggests that a tax stimulus of the right kind, along with other regulatory controls, could help slow a further downward spiral without reigniting inflation.

The Monetarist view is most clearly being advanced by Don Brash who was Governor of the Reserve Bank of New Zealand for fourteen years from 1988 to April 2002 when he became a list MP for National. The ruling class always considered him a safe pair of hands and essentially imposed him as leader of the National Party the next year following a disastrous election defeat by National in 2002 gaining only 25% of the vote.

That political venture failed at the 2005 election despite an openly racist campaign. He became the Act Party leader in 2011 but failed to get more than the one electorate seat held by Act at the time so resigned as leader. Bloggers like the former Act Party Leader Richard Prebble also argue strongly for increased interest rates and more extreme spending cuts to fight “the inflationary threat”. They condemn the current Reserve Bank for being run by Keynesian economists who don’t understand the danger.

The Taxpayers Union and New Zealand Initiative are local lobby groups for these views and are part on international right-wing networks. At least some of the NZ Initiative economists are adherents of Friedrich Hayek who has even more extreme anti-working class economic views than Milton Friedman. Hayek believed governments should not be allowed to create money at all but that it should be the work of competitive privately owned banks who would fail if they issued too much. Any attempt to introduce these policies today would collapse the economy and induce the worst depression imaginable.

A recession is coming

There are a number of warning signs signalling that rather than the “soft landing” desired by Central Banks around the world in their fight against the broad recurrence of inflation during the Post-Covid economic recovery, we will witness the outbreak of an unusually deep recession.

The first of these warning signs is the inverted yield curve in the US, UK, Europe and New Zealand. The data for a correlation is very strong.

Usually, short-term interest rates are lower than long-term. In the period preceding recessions, short-term rates rise above long-term interest rates. When this happened in the past, an economic recession followed within a few years. Most capitalist economists now claim this time is different. We’ve heard that one before from capitalist economists, most recently just before the Great Recession when the economy crashed worldwide in September 2008.

In New Zealand during the last prolonged period when it was inverted – for over three years from the beginning of 2005 till the middle of 2008 – the New Zealand economy grew steadily. But recession soon followed.

The inverted yield curve isn’t the only economic warning optimistic capitalist economists choose to ignore.

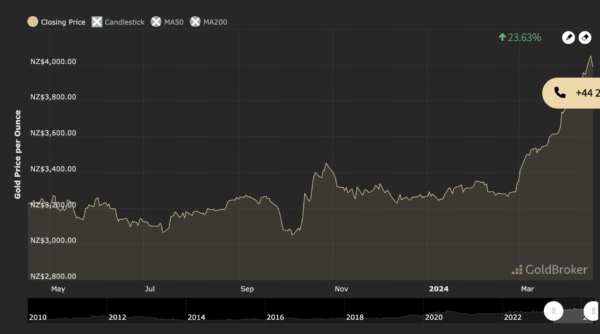

The price of gold is surging

The US dollar and the currencies linked to it under the international monetary system are falling against gold even though the US Fed has not yet lowered the interest rate by lowering the target for the federal funds rate. The mere halting of Federal Reserve System actions to raise the federal funds rate has been sufficient to push the dollar to record lows against real money – gold bullion.

The price of gold in NZ dollars is also increasing rapidly – from $3280 an ounce in late February to exceed $4000 for the first time on April 16. This is a fall in the real value of the currency in gold terms – currency inflation. NZ dollars are backed at the Reserve Bank by US dollars and other currencies as well as gold

Believers in the view that money has ceased to be a commodity in its own right since going off the gold standard in the 1970s say the dollar price of gold doesn’t matter. This is because the Federal Reserve targets the inflation rate, not the price of gold. As long as inflation rates keep falling, the Federal Reserve can lower interest rates before a full-scale recession sets in. But here, too, the latest numbers are not reassuring.

While inflation declined for a while as the inflation-breeding 2020 commodity shortages caused by government-mandated factory shutdowns faded, the decline seems to have halted, leaving the inflation rate still above the Fed’s target of about 2%. From January to March US inflation began to rise again from 3.1% to 3.5%.

Believers in non-commodity money include both Keynesian and Monetarist economists. So they can’t explain what is happening. I made an attempt to do so last year in an article titled “The Inflation Blame game – and Marx’s Crisis Theory” (See below).

To understand what is happening we need to understand the interaction of three types of money in existence today — token money, credit money and gold. Gold is a product of human labour that has emerged as the universal equivalent of all other commodities as a measure of value. All societies with a developed system of commodity production and exchange need a universal equivalent to function. Gold can also be hoarded for its intrinsic value, especially in times of monetary disorder.

Gold does not disappear in a crisis, but always retains its value. Capitalists and central banks hold a portion of their wealth or reserves in gold because of these special properties.

The second form of money is token money issued by the state, dubbed “fiat” money by economists. So long as the currency is not “over-issued” relative to the existing quantity of gold, the currency can retain its value so long as it is backed up by a state power which can impose taxes and use force on those it wants to do its bidding.

But if the currencies are “over-issued” they lose value in proportion to the over-issue. In normal circumstances, a doubling of token currency will result in a halving of its individual value. In other words, the currency price of gold will double. This is the origin of the general price inflation during the 1970s and early 1980s. Then US President Richard Nixon declared “We are all Keynesians now” and believed he could finance the Vietnam War without massive cutbacks in social spending in the US through budget deficit spending. The inevitable result was a steady devaluation of the US and other currencies, and endemic inflation worldwide.

The first casualty of this policy was for the US dollar to cut its link to gold at $35 an ounce in 1971. Keynes and Friedman claimed that policymakers would then be “free” of the gold “shackle” as it was dubbed by opponents of the gold standard. However, being free of the shackle only encouraged further devaluation. The price of gold hit $120 an ounce in 1976. Soon we had “stagflation” — inflation and economic stagnation at the same time. By the late 1970s, there was a flight from the US dollar into gold that saw the “price” of gold soar to nearly $600 an ounce.

To prevent a total collapse of the currency, the US Federal Reserve had to stop further accelerating the rate of growth of the dollar it created, which, in turn, boosted interest rates to record levels of 20% for the Federal Funds Rate and drove the country into a deep recession. Bad as inflation was — especially for the real wages of the working class being paid in debased currency — from the viewpoint of the capitalist economy the worst result was this rise in the rate of interest which wiped out profits. Inflation dropped from 14.8% in March 1980 to 3% by 1983. By the mid-1990s gold stabilised for a period at around $400 an ounce.

The recent surge in the price of gold is a massive vote of no-confidence in the monetary policy being applied by the US Federal Reserve. In just over two months we have seen a steady decline in the gold value of the dollar from around US$1800 to US$2400 – a one-third price decline. This will inevitably flow on into price rises for other commodities like oil (which is happening now) and then lead to broader inflation.

The only way to reverse course and reestablish confidence in the US dollalr as a world currency is to raise interest rates even higher than they have. The US government is terrified of such a move because they think (correctly) that it will provoke a recession in an election year that will guarantee Trump the presidency.

But not raising rates now is just as likely to make the correction that is needed in the future even more deflationary and maybe triggering another Great Depression. Keynesian economists are not our friends in this debate. You can’t make capitalism work better by simply running budget deficits or printing more money with no limit.

The only alternative to capitalism is socialism where the big monopolies are placed under public ownership and democratic control and planning.

(For a deeper look at why periodic crises are inevitable under capitalism see my article “Why Marx was right about capitalism needing to have periodic crises” )